top of page

Search

BlueScope Bid

BlueScope has received a takeover proposal valuing it at $30 a share. This unsolicited and non-binding offer has been made by a consortium composed of Kerry Stokes' SGH and the US-listed Steel Dynamics. Under the offer, SGH would aquire all of Bluescope's shares and then sell the North American businesses to Steel Dynamics. The BlueScope board says it is currently reviewing the offer. Looking back to late 2024 and early 2025, Steel Dynamics had already approached BlueScope wi

Marius Mariton

Jan 61 min read

Consumers can't avoid pessimism

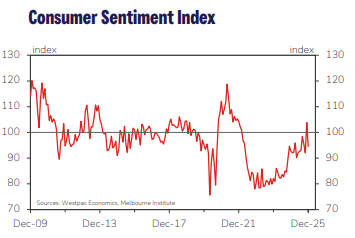

Consumer sentiment has reverted back to ‘cautiously pessimistic’ levels according to Westpac. ‘Inflation’ remains the dominant news item, along with a sharp turnaround in mortgage rate expectations. As a result, the Westpac-Melbourne Institute Consumer Sentiment fell 9% to 94.5 point in December , after it had edged up above 100 in November, the only time since reopening from the Covid-19 pandemic. While ‘international conditions’ has become a much less prominent topic, cons

Marius Mariton

Dec 16, 20251 min read

When Dr. Copper gets sick

The S&P/ASX 200 shed 0.72% to 8,635 points as it opened the last full trading week of 2025. AI bubble fears sent Wall Street lower, with these losses reverberating locally this Monday, in addition to weaknesses in the miners. With copper giving back recent gains, and iron ore prices also lower, diversified miner BHP dropped by 2.9%. Fortescue also shed 1%, on the day it flagged plans to fully acquire a Peruvian copper miner. Meanwhile the ASX stock itself was in t

Marius Mariton

Dec 15, 20251 min read

Cost concerns for Rio Tinto

Morgan Stanley has published a note on Rio Tinto, following the miner's Capital market Day. The investment bank rates the stock 'equal-weight', with a $129.50 target price. The stock has just reached a record high of around $140 on stronger copper prices, but the bank warns of higher capex in FY27, before being reduced due to lower decarbonisation spending. Morgan Stanley says the Capital Market Day was slightly below expectations which may lead to some rotation into BHP . A

Marius Mariton

Dec 5, 20252 min read

Broker Moves: Holding on to Xero until the end of the financial year?

Both Jefferies and Morningstar are flagging customer growth risks for Xero. The brokers says customer growth is being impacted by price hikes, and noted the difficulty to win new customers in a mature ANZ market. Jefferies has cut its price target to $135.50 per share, while retaining it's 'hold' rating. However, Citi has retained its 'buy' on Xero , with potential US upsides following the Melio acquisition. Meanwhile - Morningstar is forecasting subdued growth earnings for t

Marius Mariton

Nov 14, 20251 min read

Big bank blues

Higher commodity prices overnight were not enough to compensate for the weakness seen in CBA

Marius Mariton

Nov 11, 20251 min read

Coles picked the fastest lane

A batch of companies are reporting on the September quarter today... Starting with Coles , reporting a 3.9% increase in sales revenue growth. This was pushed by a 4.8% growth in Supermarkets revenue, while it was down 1.1% for the liquor segment. Meanwhile, eCommerce sales grew across both segments. Sales growth seem to be higher than Woolworth's , up 4.6% in Supermarkets and down 1.4% in Liquor, while Woolies reported a 2.7% sales growth on Wednesday. Coles adds that at the

Marius Mariton

Oct 30, 20251 min read

Santos gets Minns's stamp of approval

Santos is considering the development of gas facilities, but faces obstacles from landholders and fields owners

Marius Mariton

Oct 29, 20251 min read

China's slowing GDP growth

China's third quarter GDP growth has slowed to its lowest level in a year, up 4.8%, compared to 5.2% over the previous quarter. This was in line with expectations as a prolonged property slump and trade tensions hurt demand, keeping pressure on policymakers to roll out more stimulus. On a quarterly basis, GDP grew 1.1% in the third quarter, compared with a forecast of 0.8% While China's export growth rebounded in September, much of the recent data show the world's second-la

Marius Mariton

Oct 20, 20251 min read

Over 4,000

The S&P/ASX 200 ended the session flat, dragged down by tech stocks tracking a weaker session in New York. The local market was 0.1%...

Marius Mariton

Oct 8, 20251 min read

Sliding sentiment

The S&P/ASX 200 continued to slide from record highs, down 0.27% to 8,956.80 points this Tuesday. Consumer discretionary was the...

Marius Mariton

Oct 7, 20251 min read

Budget vs Bullion

The S&P/ASX 200 rose more than 1% to close at 8,945.9 points during Thursday's trade, supported by gains in the miners and the banks. ...

Marius Mariton

Oct 2, 20251 min read

Holding on

The RBA's decision to keep rates on hold sent the S&P/ASX 200 0.2% lower to 8,848.80 points this Tuesday, despite a positive start. The...

Marius Mariton

Sep 30, 20251 min read

ASX wrap up (23.09.25)

The S&P/ASX 200 extended Monday’s gains and finished Tuesday’s session 0.4% higher to 8,845.9 points, supported by the miners and the...

Marius Mariton

Sep 23, 20251 min read

Glitter and Gold: How the Miners Pushed the ASX Higher (22.09.25)

The S&P/ASX 200 was lifted by the miners this Monday, ending 0.43% higher at 8,810.9 points. Gold miners rallied, with Genesis Minerals ...

Marius Mariton

Sep 22, 20251 min read

Investing in housing... or in Pokemon cards

☁️ Data centres could use up to 25% of NSW water supply by 2035 🏘️ Population and housing 🎴 Pokemon cards have a better return than...

Marius Mariton

Sep 19, 20251 min read

Marius Mariton

Sep 13, 20250 min read

Marius Mariton

Sep 5, 20250 min read

Card surcharges and 5-day workweek

💳 Card surcharges cost $1.2 billion each year 👨💼 The 5-day workweek is unlikely to become a 4-day one. 💲 Total wages and salaries...

Marius Mariton

Aug 22, 20251 min read

Pokies, Ski and Tourism

🎰 ¼ of pokies in NSW clubs especially susceptible to money laundering? ⛷️ The ski industry in Australia not letting climate change stop...

Marius Mariton

Aug 15, 20251 min read

bottom of page